Montana Department Of Revenue Unclaimed Property

Montana Unclaimed Property Portal

We can find owners of unclaimed property by comparing Department of Revenue tax records to unclaimed property records. We issue a claim letter to the owner, so they know the department is safely holding this property and give the opportunity to claim the funds.

https://revenue.mt.gov/unclaimed-property/

Find Your Unclaimed Property in Montana

We want to make certain we are returning property to the rightful owner while following statutory requirements. Under Montana Law (15-1-802, MCA) all tax payments equal to or greater than $50,000 must be made electronically starting January 1, 2026. Find Your Unclaimed Property in Montana Frequently Asked Questions Claim refunds will be issued from the Montana Department of Revenue on a paper check.

https://revenue.mt.gov/unclaimed-property/claims

Montana Unclaimed Property Reporting

If the owner is due $50 or more, an attempt to locate the owner, known as due diligence, must be performed before remitting the property. A letter detailing the amount due the owner and requesting a positive confirmation from the owner should be sent to the owner’s last known address or new address if one is available.

https://revenue.mt.gov/unclaimed-property/report

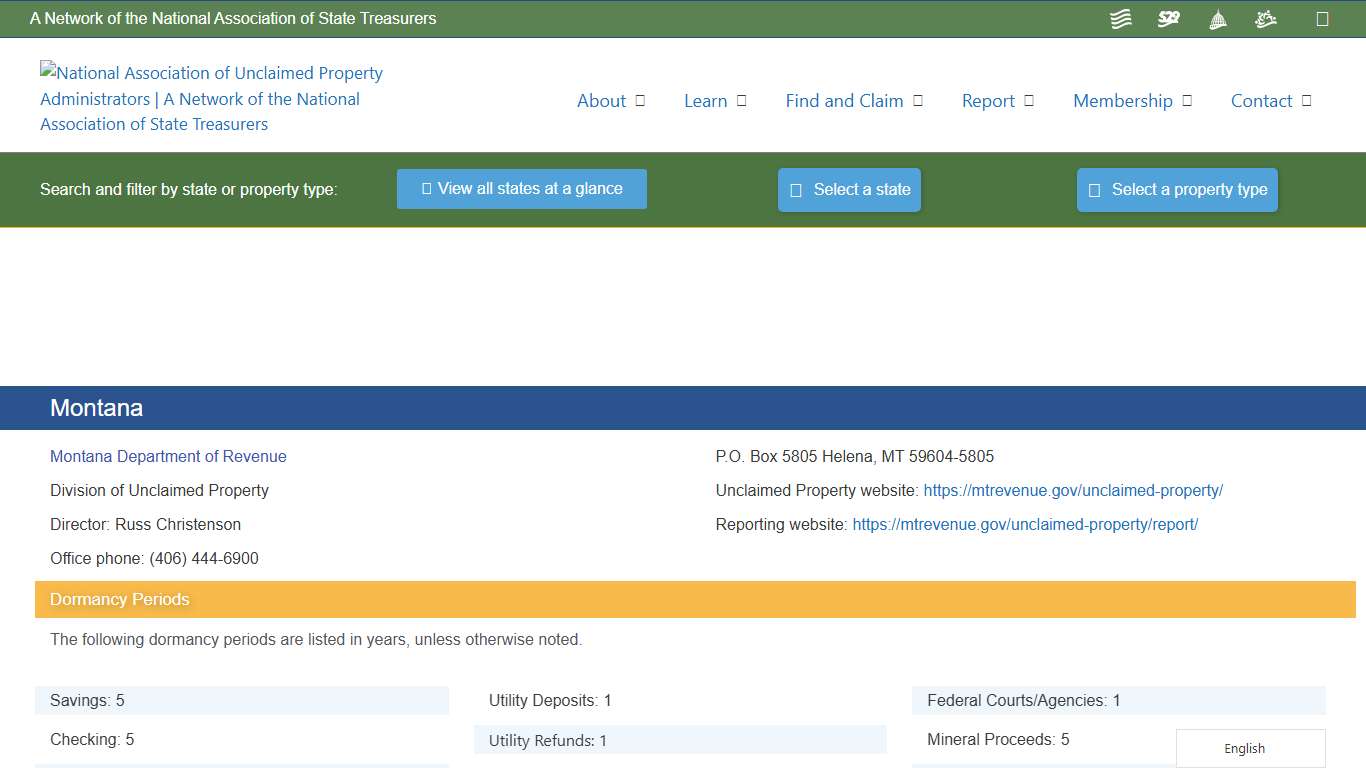

Montana – National Association of Unclaimed Property Administrators (NAUPA)

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/montana/

Lawsuit filed against SB 542 as property tax frustration mounts

13:30 News Story This story was updated at 11:45 a.m., on Jan. 22 to reflect Rep. Llew Jones’ comments. Two state senators and a former lawmaker filed a lawsuit on Wednesday against an omnibus piece of legislation that made broad changes to property tax law, alleging it doesn’t adhere to the state constitution.

https://dailymontanan.com/2026/01/21/lawsuit-filed-against-sb-542-as-property-tax-frustration-mounts/

Montana - 1 in 7 Americans have unclaimed property, like gift ...

... 2026. All competitive bid opportunities and the ability to submit a bid are now located on TransAction Portal (TAP) To learn more: https://revenue.mt.gov ...

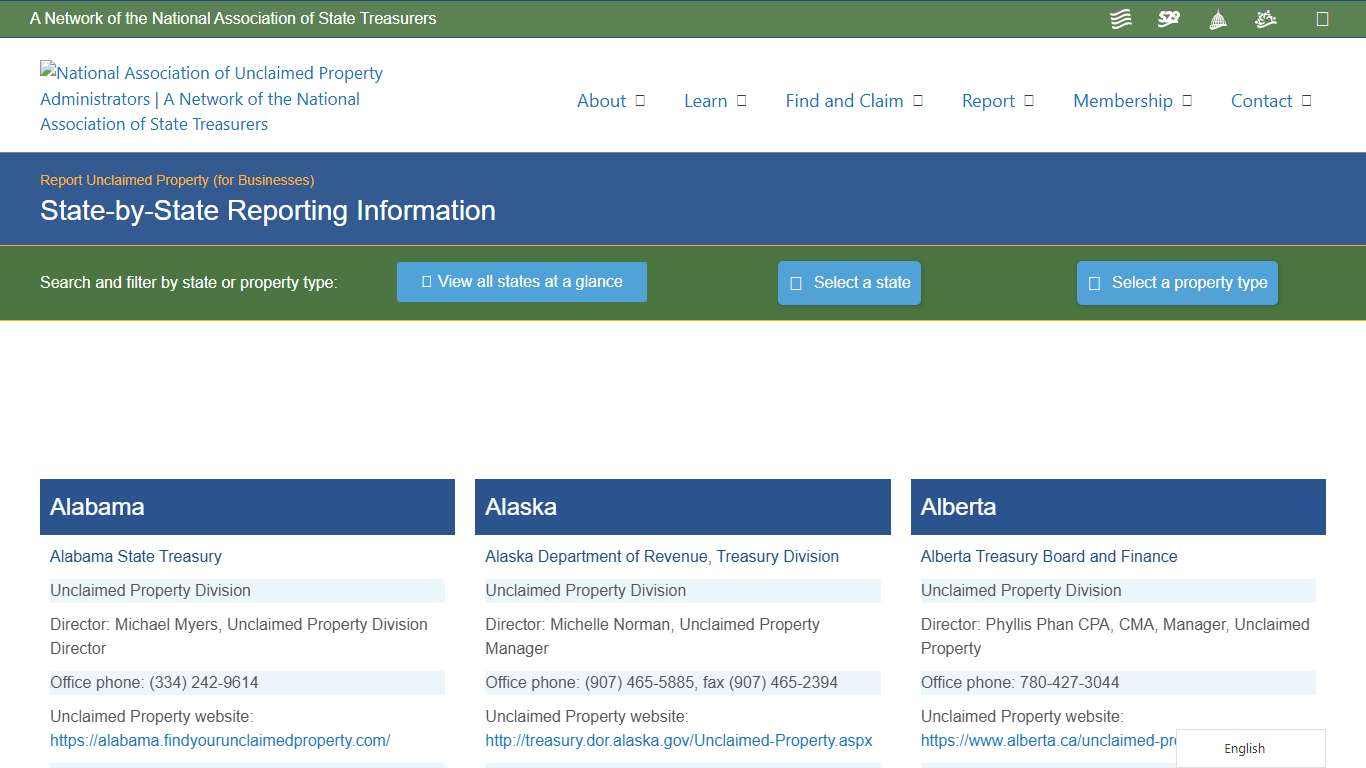

https://m.facebook.com/MTRevenue/photos/1-in-7-americans-have-unclaimed-property-like-gift-certificates-unpaid-wages-or-/1001023962047967/State-by-State Reporting Information – National Association of Unclaimed Property Administrators (NAUPA)

Montana Department of Revenue. Division of Unclaimed Property. Director ... Copyright 2026 · National Association of Unclaimed Property Administrators ...

https://unclaimed.org/state-reporting/

Montana Department of Revenue

Under Montana Law (15-1-802, MCA) all tax payments equal to or greater than $50,000 must be made electronically starting January 1, 2026.

https://revenue.mt.gov/

🎁 Looking for a surprise this holiday season? The best gift might already be yours! Montana could be holding unclaimed money in your name. No wrapping or shopping required—just visit https://mycash.mt.gov and search for free. #MontanaHoliday #UnclaimedGifts #ChristmasCash No wrapping or shopping required—just visit https://mycash.mt.gov and search for free. #MontanaHoliday #UnclaimedGifts #ChristmasCash No comments yet. Start the conversation.

https://www.instagram.com/montanarevenue/p/DSp1-UjEpRa/

HB164 Montana 2025-2026 Revise the uniform unclaimed property act - Legislative Tracking PolicyEngage

− Full Texts (33) − Actions (38) On April 7, 2025 in the House: - (H) Signed by Governor - Chapter Number Assigned On March 31, 2025 in the House: - (H) Transmitted to Governor On March 31, 2025 in the Senate: - (S) Signed by President On March 28, 2025 in the House: - (H) Returned from Enrolling - (H) Signed by Speaker On March 26, 2025 in the...

https://trackbill.com/bill/montana-house-bill-164-revise-the-uniform-unclaimed-property-act/2593778/

Job Description - Tax Examiner 1 - Withholding Unit (26140066)

Our services impact EVERY Montanan! MISSION STATEMENT To be the nation's most citizen oriented, efficiently administered, state tax agency. The Montana Department of Revenue administers almost 40 state taxes, property appraisals, alcoholic beverage laws, cannabis laws and unclaimed property for the state of Montana.

https://mtstatejobs.taleo.net/careersection/exm/jobdetail.ftl?job=26140066&lang=en

Tax Policy Highs and Lows from the 2025 Montana Legislature

Tax Policy Highs and Lows from the 2025 Montana Legislature Rose Bender Jun 9, 2025 8 min read Updated: Dec 2, 2025 Download Report PDF The Montana budget serves as a collective tool to invest in keeping Montana a great place to live, work, and raise a family.

https://montanabudget.org/report/tax_2025_leg

Unclaimed Property Day is Back, Returning Money to Montanans

Unclaimed Property Day is Back, Returning Money to Montanans January 15, 2025Helena– The State of Montana is currently holding approximately $148 million dollars in unclaimed or abandoned property that belongs to state citizens. “That $148 million dollars is real money that belongs to Montanans.

https://revenue.mt.gov/news/recent-news/Unclaimed-Property-Day-is-Back-Returning-Money-to-Montanans

5 Key Facts About Medicaid and Provider Taxes KFF

5 Key Facts About Medicaid and Provider Taxes The 2025 reconciliation law imposes significant new restrictions on states’ ability to generate Medicaid provider tax revenue, including prohibiting all states from establishing new provider taxes or from increasing existing taxes as well as reducing existing provider taxes for states that have adopted the Affordable Care Act (ACA) Medicaid expansion.

https://www.kff.org/medicaid/5-key-facts-about-medicaid-and-provider-taxes/

Abandoned property rules: The beginner’s guide to compliance Wipfli

Abandoned property rules: The beginner’s guide to compliance - Abandoned property rules require businesses to identify and report assets that have gone unclaimed for a specified dormancy period, usually one to five years. - Compliance involves following state-specific escheatment laws, sending due diligence notifications to owners, and meeting varying reporting deadlines.

https://www.wipfli.com/insights/articles/tax-understand-the-rules-related-to-unclaimed-property-in-your-state